In our brand equity thought leadership series, we have looked at what brand equity is and how to measure it, before shifting attention to the distinctive brand assets that drive sales. Guided by two sizeable Kantar studies, we then laid down a solid case for the importance of monitoring touchpoint landscapes and uncovered the optimal channel spend allocation for media effectiveness. And we discussed the role of emotions and the hotly debated notion of building brand equity through meaningful difference and purpose.

In this penultimate article, we turn the spotlight on the forces of influence that can shape, and deepen, consumers’ perceptions that lead to strong brand equity.

Inside consumer’s minds

In 2017, McKinsey published a cornerstone article based on new data about the real consumer decision-making journey. It evolved the old funnel model and identified a truly cyclical process. Crucially, it validated what we already knew: that brands needed to ‘hook them early’, since initial consideration explained more than 60% of growth. In 2019, Kantar analysis of growth drivers again concluded that market share growth was dominated by creating brand predisposition.

The Kantar BrandZ global brand equity study has collected a wide range of data on perceptions of brands since 1998, among consumers and business decision-makers. It relates these to brands’ ability to drive demand, both in the short and long term. It uses a validated approach called the Meaningfully Different framework to capture metrics that are predictive of sales – based on demand (Power) and willingness to pay (Premium).

But why are some brands perceived to be more Meaningful, Different and Salient than others?

New analysis reveals the drivers of consumer perceptions that contribute to the brand equity measures of Power and Premium.

Unlocking consumer perceptions

We conducted a two-stage analysis on data from over 400,000 respondents in 2019-20, covering over 11,000 brands. First, we converted 28 attributes into 18 brand image pillars using factor analysis. Next, we used Brand Structures Analysis (based on Bayesian modelling) to create a complex model of relationships between the brand image pillars and Meaningful, Different, Salient and Power metrics.

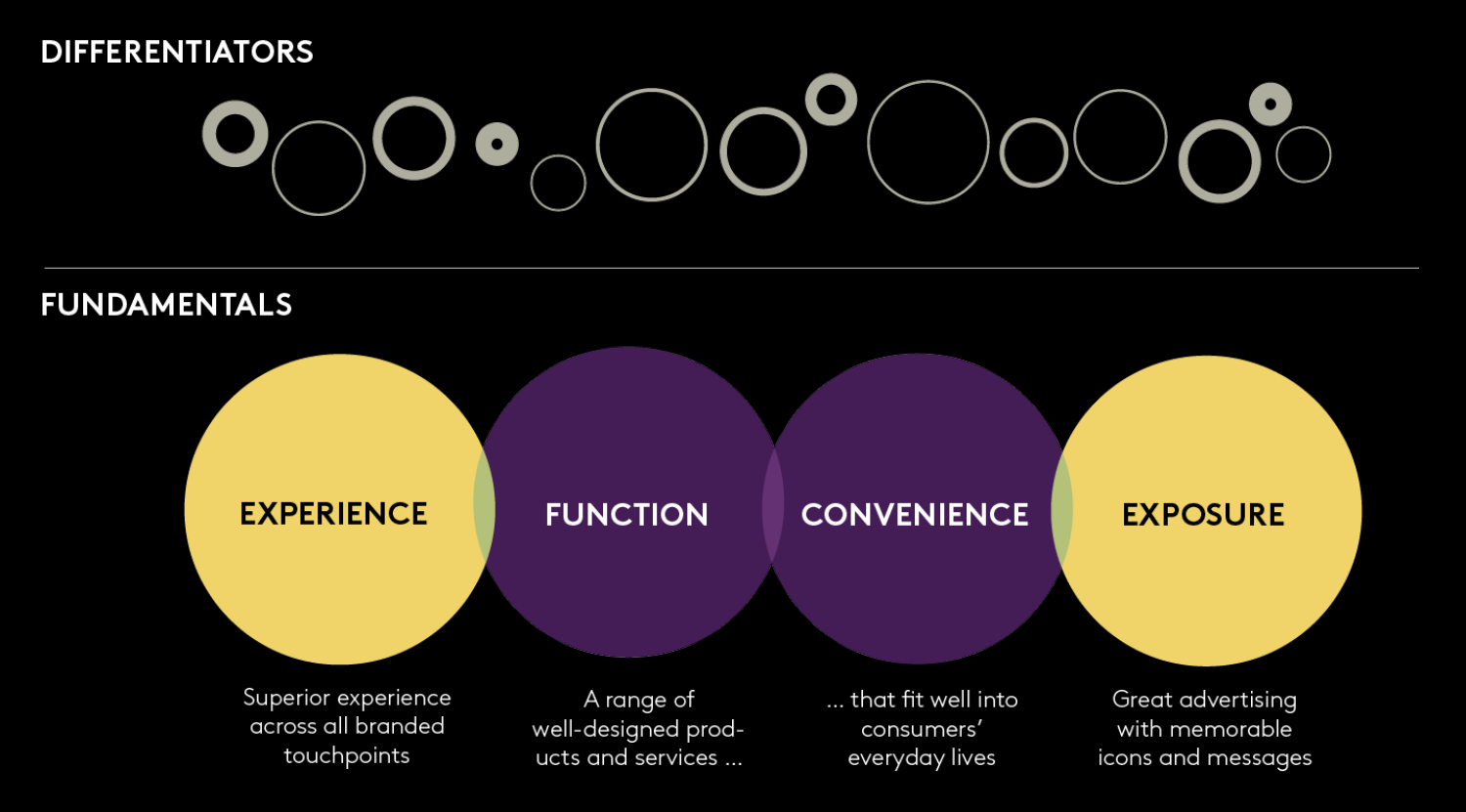

All brand image pillars had some contribution to the Power metric. However, the most significant finding was how four fundamental areas typically account for around 70% of brand equity globally. These areas should receive more focus and attention from marketers for every brand. The remaining 30% can be built from a wide range of brand-specific differentiating attributes and perceptions.

The four fundamentals of brand building

The four fundamental areas are:

- Experience. Strong brands both meet the expectations of new users and continually deliver a superior experience to regular users. The memories laid down by these experiences are one of the key foundations of a brand’s relationship with its customers.

- Exposure. The best brands are created in the mind of the consumer through great communications, which define the brand and ‘frame’ the actual product or service experience. Messaging needs to be relevant, memorable, creative and consistent.

- Functionality. Ensure you offer a product or service that is seen as well-designed with a suitable range of options – and innovate as necessary.

- Convenience. In a consumer-led environment, it is essential for brands to fit seamlessly into the everyday lives of users. Brand choice should be habitual and easy, without the need for conscious thought from busy consumers.

Clearly, circumstances vary depending on the nature of the brand, the market, the category and the types of customers involved. This will affect the overall importance of the four fundamentals and the relative importance of each.

Together, the four fundamentals relate to consumer perceptions shaped by good management – and synergy – of the basic elements of marketing: product, place, price and promotion. The design of the product or service, its efficacy or quality of delivery, its packaging and handling; all these marketing decisions will impact the fundamentals. A brand’s distribution channels can also shape the experience and impact its convenience. Its pricing will set expectations for experience and quality, and effective promotion will ensure the brand is always mentally available.

Bringing the Fundamentals to life: examples from Kantar BrandZ

Experience

Retail and airline categories have brands that excel in delivering a great experience. Great experiences increasingly come from online shopping environments. Two of the best-perceived brands are JD in China, and bol.com in the Netherlands.

Airlines, particularly national carriers such as KLM, Emirates, ANA and Lufthansa, evoke a sense of national pride and an emotional connection with users. This strengthens the memories of flying with them and makes them more Meaningfully Different than other carriers.

Exposure

Many brands have been awarded for the creativity and effectiveness of their communications. The right messages, resonating through memorable devices and stories, are a vital part of marketing. Brands like Pampers, Nike, Heineken and Nintendo stand out in our database as achieving this consistently over time to build up a store of positive brand associations that feed both the Type 1 and Type 2 decision-making parts of the brain.

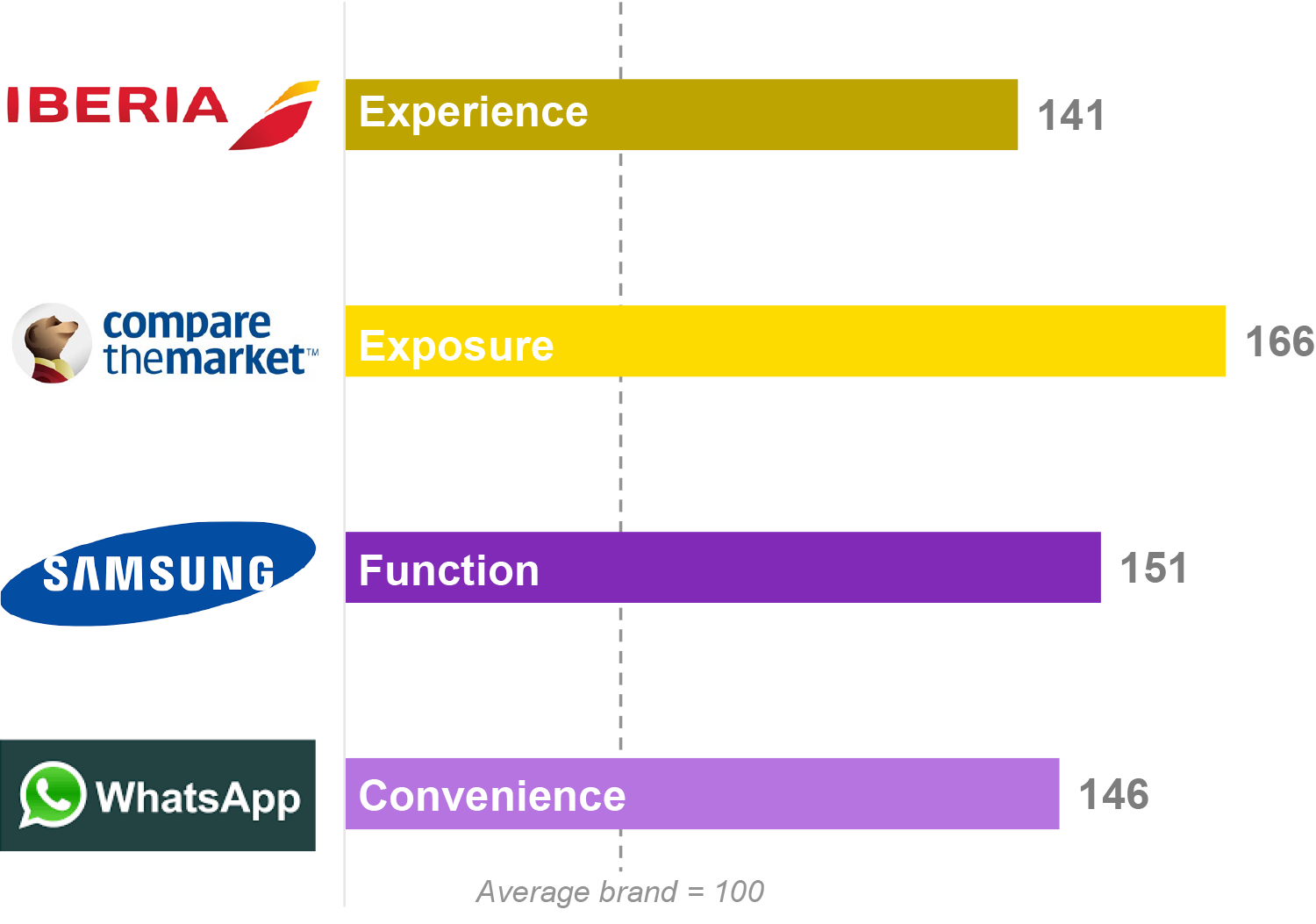

Two of the strongest examples are well known for their use of furry friends in the UK: the Dulux sheepdog and, with data shown below, comparethemarket.com, a price comparison website, promoted through a loveable – if unconventional – meerkat family.

Functionality

Meeting the basic needs of consumers is summarised by two attributes: having well-designed products or services, and offering a good range. Almost all leading brands perform well in these areas but two brands that stand out are Amazon and Samsung. Both are democratic brands that try hard to bring the best to everyone. Amazon retail – across more than 50 studies around the world over the last two years – has an average index of 126 on Functionality.

The example below shows Samsung in its home market of South Korea for consumer technology, but results are equally strong in mobile phones, consumer electronics and domestic appliances in many countries around the world.

Convenience

Our evidence shows that consumers have increasingly adopted brand ecosystems – choosing products that work well together and fit seamlessly into their everyday lives. People prefer simple choices. Convenience has become king in a time-pressured world.

Some of the best performers are digital native brands that put the world into the palm of your hand through mobile applications, like WhatsApp, Just Eat and Meituan, the Chinese delivery brand that connects consumers to over 200 product and service categories, from ride hailing to food delivery and even movie ticketing.

As the data from WhatsApp in South Africa shows, the brand’s primary value to its users is the reliable simplicity and ease with which it can keep them in touch with everything that’s important to them.

Excelling in the fundamentals

Strong brands perform well on all four fundamentals

Analysis of Kantar BrandZ Global brand valuations in 2021 shows that the most valuable brands typically perform better across all these fundamentals.

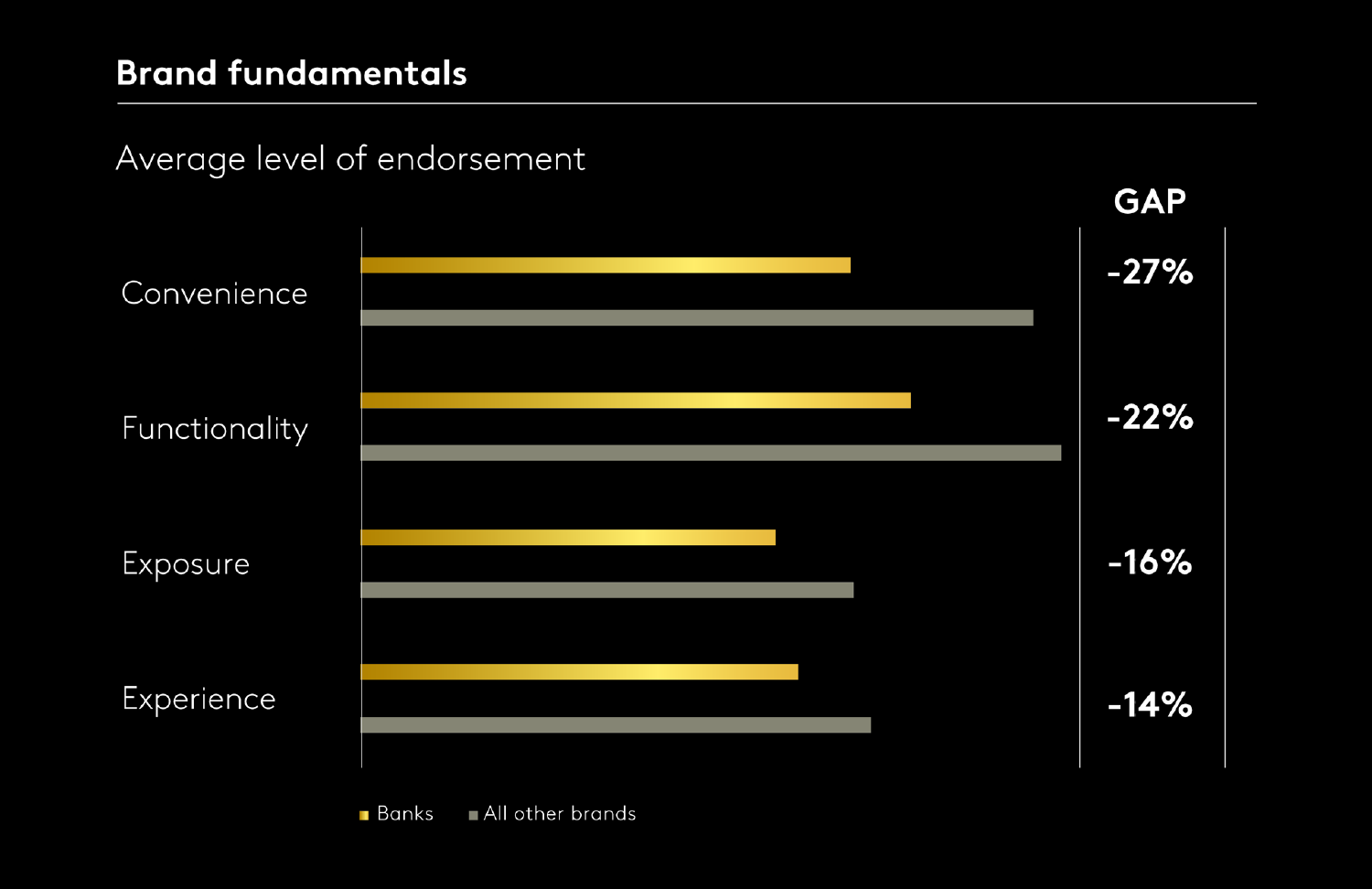

Underperforming on the Fundamentals should raise concern. Compared to the average, Kantar BrandZ’s 15 most valuable global banking brands don’t perform well across all four fundamentals and their growth rate lags behind brands in other categories. The banking sector grew on average 10% in brand value (2020 to 2021) compared to 42% growth for the top 100 brands. In particular, banks show the biggest deficit on Convenience – the ability to fit easily into everyday life. This suggests that new fintech companies using smart digital technology to disrupt the sector have a major weakness to address to drive growth.

Brand fundamentals: banking

Track and benchmark your progress against competitors

The metrics behind the four fundamentals are trackable in every Kantar BrandZ study, and can be easily replicated in brand tracking studies. Any brand can use them to benchmark their performance against competitors and understand better how to drive demand. Together they create an actionable focus for brand management and marketing strategy: a blissful blended scorecard of short and long term indicators that becomes your journey towards sustainable growth. It reveals the key steps and obstacles through a simple analysis of Experience, Exposure, Functionality and Convenience. Executing well against consumer expectations in each of these areas may not be easy, but knowing where you need to get to, and measuring your progress along the way, will make marketing your brand more manageable.

Get in touch to find out more about the four fundamentals and how they can help drive demand for your brand.